Encouraging investment thru’ economic zones for rapid economic growth by A Z M Azizur Rahman

Investment is the prime vehicle for a country’s overall development and progress, especially in the developing countries like Bangladesh. The contribution of Foreign Direct Investment (FDI) and local investment in the economic sector is immense. Investment is inextricably linked to foreign exchange earning, poverty alleviation, employment generation, technology transfer, skill development, export growth, development of backward and forward linkage industries, establishment of satellite town and service-oriented and supportive service industries and overall economic emancipation of the people. So, rapid growth of the private sector through FDI and local investment is the major driving factor for the massive economic development of Bangladesh. Visualising the necessity of FDI and local investment, the government took the decision to set up Export Processing Zones (EPZs) initially. After the astounding success of EPZs, the government has decided to establish 100 Economic Zones (EZs) in the country.

The government has also a plan to establish Private Export Processing Zones in Bangladesh so that the government or any foreign or Bangladeshi companies can set up Economic Zones, Private Economic Zones or Private EPZs.

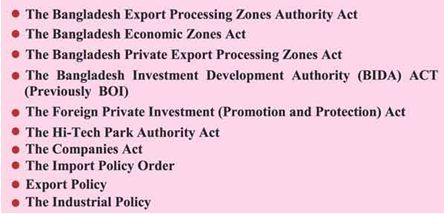

To attract and encourage more local investment and FDI, the government has put in place the following legal frameworks:

The present investment-friendly government is offering a very competitive and wide range of incentive packages and facilities to the investors. The overall investment climate featuring low-cost production base and low-cost of doing business is favourable to foreign investors. Bangladesh has been consistently updating and modernising its foreign and local investment policies. The existing investment and industrial policy has put greater emphasis on free economy, deregulation, promotion of private sector and overall macroeconomic structural adjustment. To ensure speedy economic development, the government is going to implement “One Stop Service” for simplification of the investment procedures. Moreover, the government is going to formulate a new Customs Act. Rules, regulations and documentation procedure have also been framed to make the investment procedure simple and easier.

The major investment-oriented organisations playing a dominant role in Bangladesh are as follows:

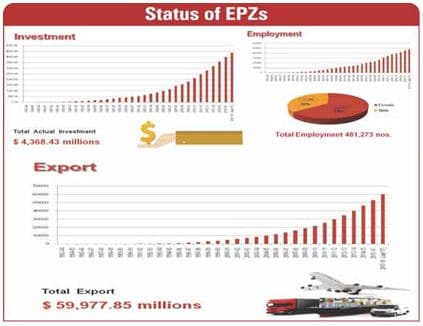

Export Processing Zones (EPZ): The Bangladesh Export Processing Zones Authority Act was passed in parliament. Bangladesh EPZs Authority (BEPZA) is an organisation which has been working under the guidance and leadership of the honourable Prime Minister. It has been tasked with creation, development, operation and management of the Export Processing Zones (EPZ).

Since its inception, BEPZA is engaged in attracting and facilitating foreign and local investment in the EPZs of Bangladesh. The primary function of an EPZ is to provide a special enclave where the investors would find congenial investment climate free form cumbersome procedures.

Types of Investment

Type A: 100 per cent foreign ownership.

Type B: Joint venture between Bangladesh and foreign investors (no limit on extent of equity share).

Type C: 100 per cent Bangladeshi ownership.

Economic Zones (EZs): Modern Special Economic Zones (SEZs) appeared in late 1950s in the industrial countries. The first one is in Shannon, Clare, Ireland. From the 1970s onward, such economic zones housing labour-intensive manufacturing units have been established, starting in Latin America and East Asia. Former Chinese leader Deng Xiaoping opened the Shenzhen Special Economic Zone, the first in China, in 1979, which encouraged foreign investment and simultaneously accelerated industrialisation in this region. The SEZs attracted investments from multinational corporations.

There has been a recent trend of African countries setting up SEZs in partnership with China.

The EZs contribute to diversification in two ways: First, by attracting manufacturing activities to predominantly resource-based developing countries, EZs add to the diversity of economic activities just through their very existence. Secondly, EZs can stimulate the mainland economy through productive linkages. The latter can be vertical by increasing demand for intermediate goods that are produced on the mainland; or horizontal by demonstrating the feasibility of manufacturing non-traditional products.

Objectives of Economic Zones

The objectives of Economic Zones can be explained as:

- Generation of additional economic activity;

- Promotion of exports of goods and services;

- Diversification of export destination-wise and product-wise;

- Promotion of investment from domestic and foreign sources;

- Creation of employment opportunities;

- Development of infrastructure facilities and logistic services;

- Technology transfer;

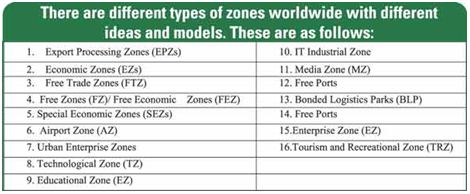

There are different types of zones worldwide with different ideas and models. These are as follows:

The Bangladesh Economic Zones Authority (BEZA) has targeted to set up 100 EZs in the country and 47 of them, including government and private EZs, are under processing or in the implementation stage.

Private Export Processing Zones (Private EPZs)

The government has enacted The Private Export Processing Zones Act to allow foreign and local investors to set up Private EPZs. Meanwhile, a South Korean Company, Youngone Corporation, has set up Korean EPZ (KEPZ) in Chittagong on 2,492 acres of land on the other side of Karnaphuli river. A large RMG and shoe industry has started its operation with around 18,000 workers. The company has been expanding its operation. It has also a plan to establish a high valued technical textile zone within KEPZ. With an investment of US$ 6 to 7 billion, the Korean EPZ may employ around 400,000 direct and indirect workers upon completion of the project.

The writer is a former member of BEPZA and presently Advisor of Foreign and Local Private Economic Zone (EZ) and Industries.